Project Package includes:

- Full Source Code of the Project.

- Free Installatiion Support Remote ( Anydesk, Zoom, Gmeet)

- Phonepay & Paytm Payment Gateway only for Indian.

- WhatsApp Us – +916263056779

The project or Report are Downloadable immediately after payment is made successful.

Goals/Outcome

- Determining probability of user liability

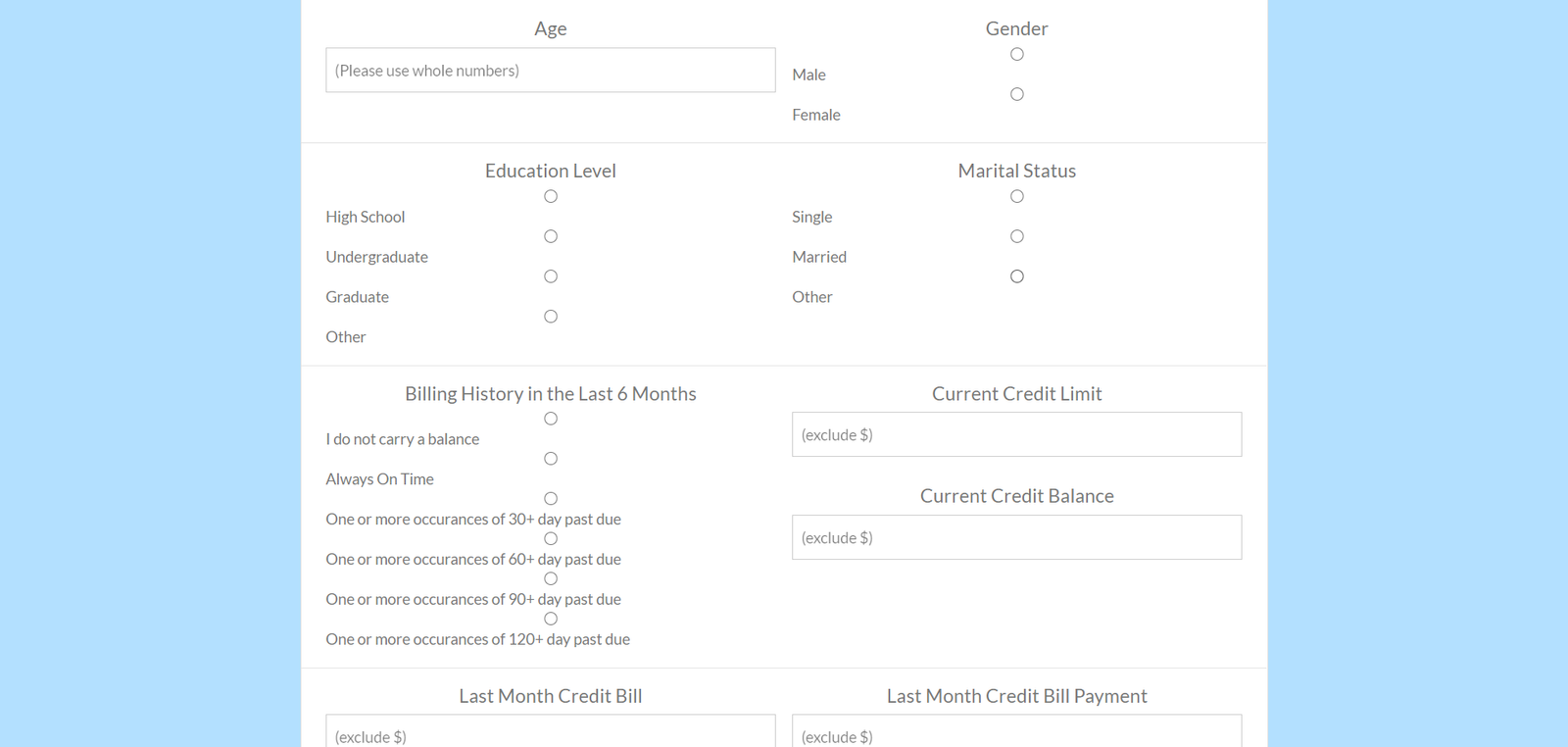

- Creating an interactive UI that will take users input and return an output

- To determine if a neural network vs logistic regression is the better model for classification

Models Created

- Logistic Regression

- Random Forest Model

- Deep Neural Network

There are no reviews yet.